Opay is giving debit cards to every eligible customer. You can order the debit card and get it delivered to your house or area.

Before writing this article, I’ve got my Opay card so I will guide you on how to get yours.

If you think there is something special about the card, there is nothing special about it. It is just like other debit cards out there that can be used to withdraw money in ATM or POS centers.

I have been using the Opay card now for a week, and all I can say is that it is good and I love it.

Just like other ATM cards, there are things I like about them, we’ll discuss that later in this guide.

You should know that Opay gives virtual cards and physical debit cards like your bank debit card.

What is Opay Debit ATM Card?

Opay debit card is just like other bank debit cards, you can withdraw from ATM and any POS merchant.

The card was introduced in 2021 by Opay to reward customers when you make use of it.

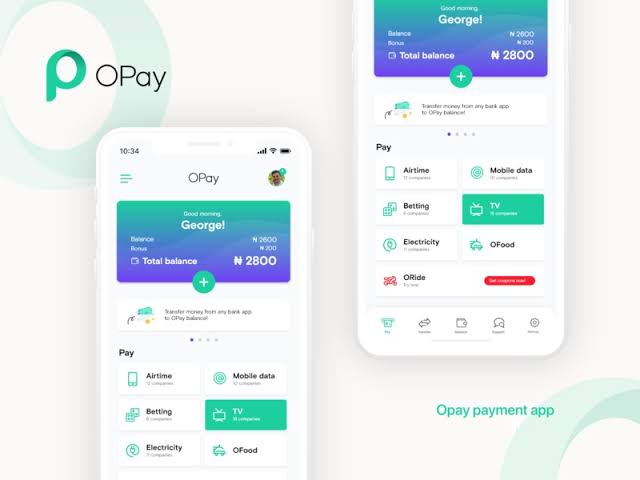

Opay started as a mobile fintech, you can use it for sending and receiving money, purchase airtime or data, and even save your money and get rewards.

The idea behind the Opay debit card is to give you more options, you can now withdraw directly from your Opay account.

Of course, you can withdraw from your Opay account before but is either you send it to your bank with an ATM card or you withdraw from the Opay agent through transfer.

It is not possible before to withdraw directly from the Opay account, but it is possible now with the debit card.

The virtual card is mainly for online payments, you can purchase with the virtual card too virtually.

Opay card features

This feature is all that you’ll enjoy when you get the Opay debit card:

- Zero maintenance fees

- Acceptable anywhere in Nigeria

- Withdraw from any ATM

- Make a payment online in naira

- Unlimited cashback

- Free ATM withdrawal

There are some features not mentioned in the list above.

How to apply for the Opay debit card

Before you can apply for the Opay debit card, make sure that you are already on either stage 2 of the KYC or 3.

The default KYC (Know Your Customer) level 1 is not eligible for the Opay card, you need to link your BVN and upgrade to KYC level 2 before you can request the Opay debit card.

If you are already on the KYC level 2 or 3, then follow this method:

- Open or login to the Opay app

- Tap on Cards in the bottom tab menu

- You will see the virtual debit card first, swipe to the left to switch to the tab to request a physical debit card or rather request for the virtual card.

- You have to provide all the information Opay demands to be eligible for their debit card.

- You will be asked to enter your home or nearest bus stop address for delivery.

- You’ll pay ₦600 to request the Opay card.

That’s all, you’ll get your ₦600 back as cashback after you receive and activate the card.

How long before the card gets delivered to you

I got mine within 2 weeks after I requested it, you should wait after your request. It takes about 2 days to get your card printed, and after it is printed it will be shipped to the address you provided.

I got a call from the dispatch rider and got my Opay debit card the same day. You should probably wait after requesting the card until you receive the call from the dispatch rider.

How to activate the Opay debit card

After you receive your card, it is time to activate it and start making use of it.

Login to the Opay app and go to the Cards tab, tap on Activate Card.

Enter the information in the box provided and input the PIN code you want to use for your Opay card. Then it should get activated, you can try again if it failed at first, mine was activated successfully after two trials.

You’ll get your ₦600 as cashback after you activate the Opay debit card.

How to get an Opay virtual debit card

This is a virtual card by Opay, and it’s meant to be used virtually. You have to link your BVN as well to get this and it’s good if you want to purchase things online.

Opay card limits

Opay debit card limit depends on your KYC level, the KYC level 3 is the best if you want to break limits. KYC level 2 is better for the average customer.

The Opay debit card has a lot of advantages and it has zero maintenance fees, something that banks don’t do. You still get cashback when you use the card and it is just amazing.