So you need some cash quickly but don’t want to deal with sky-high interest rates and short repayment terms. Monthly payment loans are a great option if you’re looking for an affordable loan that fits your budget. These loans offer lower interest rates and fees since you’re repaying over a longer period.

In this article, we will be discussing so many options out there, how do you choose a reputable lender for your needs. We’ve done the research to find the top monthly payment loans in Nigeria so you can get the money you need without worrying about hidden fees or strict deadlines. Whether you need to pay for an emergency, consolidate high-interest debt, or cover essential expenses in between paychecks, these lenders have you covered with fast approval and flexible terms.

Keep reading to explore your options and find a monthly payment loan that gives you breathing room and peace of mind. The money you need is just a few clicks away.

Types of Online Loans With Monthly Payments in Nigeria

There are a few types of online loans with monthly payments available in Nigeria.

1. Short-Term Loans

These small, unsecured cash advances are repaid over 3 to 6 months. Popular options are payday loans and installment loans, allowing you to borrow ₦50,000–₦500,000 with high interest rates. Only use short-term loans for emergencies since rollover fees can lead to a cycle of debt.

2. Personal Loans

Unsecured personal loans of ₦100,000 up to ₦5 million+ are repaid over 6 months to 5 years. Interest rates are lower than short-term loans. Personal loans can be used to pay for home improvements, medical bills, tuition, debt consolidation, and more. Compare offers from banks, credit unions, and online lenders.

3. Credit Cards

If used responsibly, credit cards allow you to borrow money interest-free for up to 45 days. Only spend what you can pay off each month. Rewards cards provide cash back, travel points or gifts. Shop around for a card that suits your needs with a limit you can manage.

4. Crowdfunding

Crowdfunding sites like GoFundMe, Mpesa, and GiveNigeria allow people to raise money from friends, family, and individual donors for important life events, emergencies, creative projects or business ventures. Set a fundraising goal and share your campaign to social media. Donors contribute and receive updates on how funds are used. An affordable way to get quick cash with no interest or fees.

Evaluate your options based on the amount you need, terms that fit your budget, and the purpose of the loan before choosing a lender.

READ ALSO: Best Online Payment Platforms in Nigeria

Top Lenders for Monthly Payment Loans in Nigeria

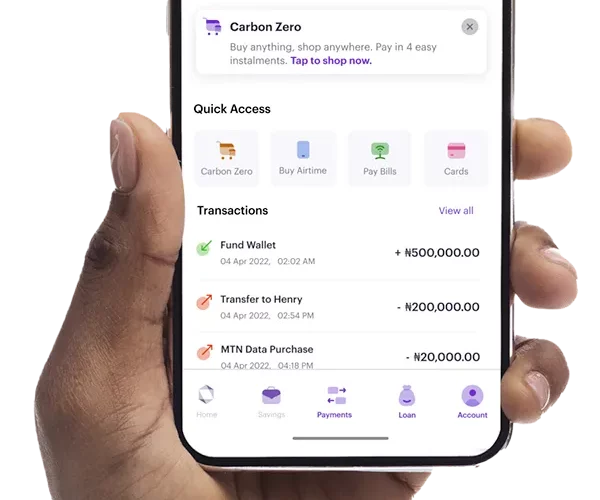

When you need cash fast in Nigeria, there are a few lenders that offer monthly payment loans you can apply for online.

1. Renmoney

Renmoney provides personal loans up to 5 million Naira with 3 to 12 months to pay back. Interest rates start around 3.5% per month. They have a quick online application and funds can be in your account within 2 days.

2. Paylater

Paylater offers short-term loans from 5,000 to 500,000 Naira with 1 to 3 months to repay. Their interest rate is around 5% per month. They have an easy online application with an instant decision and money can be sent straight to your account.

3. Aella Credit

Aella Credit provides personal loans from 100,000 to 5,000,000 Naira with 3 to 12 months to pay back. Their interest rates start around 3.5% per month. You can apply online and get approved within 2 days with money sent directly to your bank account. They report loan payments to credit bureaus so you can build your credit history.

4. Branch

Branch offers personal loans up to 500,000 Naira with 1 to 6 months to repay at around 4% interest per month. They use an innovative mobile app to assess creditworthiness and you can get money sent to your account quickly after approval. Loan payments are reported to credit bureaus as well.

With so many reputable lenders now offering monthly installment loans in Nigeria, you have options to find one that meets your needs. Compare rates and terms to find a lender you can trust so you can get the money you need on a payment plan that works for your budget.

READ ALSO: Online Electricity Bill Payment

How to Apply for a Monthly Payment Loan in Nigeria

To apply for a monthly payment loan in Nigeria, follow these simple steps:

1. Find a reputable lender

Do some research to find licensed and accredited lenders that offer monthly installment loans. Check online reviews and ratings to determine reputable companies. Some recommended options include Branch, Paylater, and Aella Credit.

2. Check eligibility

Make sure you meet the basic eligibility criteria which typically includes:

- Being 18-65 years of age

- Having a steady source of income

- Having a bank account

- Providing identification documents like BVN, driver’s license or international passport

If you meet these and the lender’s specific criteria, you have a good chance of being approved.

3. Apply online

The application process for most lenders is straightforward and done completely online. You will need to provide some personal information like your name, address, income details and the loan amount you need. The lender will review your application and let you know if you are approved within 1-2 business days.

4. Review and sign

If approved, the lender will provide the full details of your loan including the interest rate, fees, payment schedule and terms. Carefully review all the information to make sure you understand the agreement fully. If everything looks acceptable, e-sign the contract to finalize your loan.

5. Get funded

Once you sign, the lender will deposit the approved loan amount directly into your bank account, usually within 24 hours. Your repayments will start on the next pay period as per your agreement. Make sure to pay on time each month to avoid late fees and a negative impact on your credit.

Conclusion

Following these key steps can help you access the funding you need through a reputable monthly installment loan in Nigeria. Be sure to borrow only what you need and can repay to avoid getting caught in a debt cycle. Monthly payment loans can be a useful option if used responsibly.